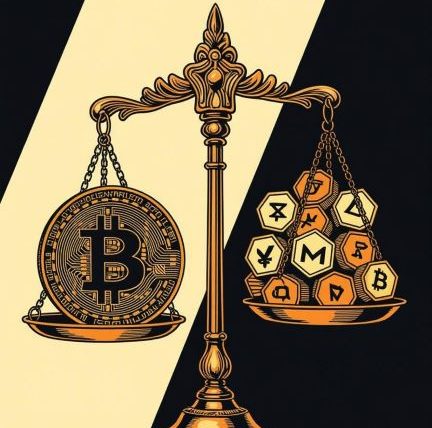

Bitcoin’s price can jump $200 between two exchanges in a heartbeat. One platform lists it at $60,000, another at $60,200. Those gaps? They’re a trader’s playground. Crypto arbitrage tools spot these differences faster than you can blink. They’re like having a buddy who’s always one step ahead, pointing out deals in a bustling market. Let’s dive into how these tools are shaking up money trading.

Chasing price gaps isn’t new—it’s as old as markets themselves. Picture traders in the 1800s haggling over goods across ports. Now, swap ships for servers. Tools like crypto arbitrage scanner make it a breeze to catch price differences between exchanges. They scan platforms like Binance or Kraken in real time, flagging chances to buy low and sell high. It’s like having a treasure map for crypto profits, guiding you through the market’s twists and turns.

How These Tools Pull Off the Magic

Imagine a busy marketplace where every stall prices coins differently. That’s crypto in a nutshell. Exchanges don’t talk to each other. Prices wobble based on demand, location, even time of day. Arbitrage tools act like eagle-eyed scouts. They check dozens of exchanges like Coinbase and KuCoin, and spot mismatches in seconds.

- They compare prices for the same coin across platforms.

- They figure out your profit after pesky fees.

- They ping you when a gap’s worth chasing, like a 1% difference or more.

Ever heard of triangular arbitrage? It’s a clever trick. You trade three coins in a loop (example: BTC to ETH, ETH to USDT, then USDT back to BTC) across different exchanges. If the stars align, you pocket extra coins. Tools do the math for you, dodging market swings.

“It’s like a cheat code for trading,” says Sarah, a part-time trader who boosted her portfolio 8% in a month. Speed matters, though. Blink, and the gap’s gone.

The Upside: Why Traders Love This Game

Who doesn’t love a low-risk win? Arbitrage skips the rollercoaster of betting on price spikes. You buy cheap, sell high, and lock in gains before the market flips. Traders talk of 5-10% monthly returns with the right moves. “I started with $500 and doubled it in two months,” grins Jake, a college student trading between classes. It feels like finding spare change, only better.

- Fast cash: Trades wrap up quick, freeing your money.

- Spread the love: Work with multiple coins to dodge big losses.

- Learn as you go: Tools show you the ropes while you profit.

These tools are getting smarter, too. In 2025, some use AI to predict gaps before they happen. Others tap into flash loans: borrowing big, trading fast, and repaying in one go. It’s a high-tech twist on an old-school hustle, and traders can’t get enough.

The Catch: Risks You Need to Know

Every rose has its thorns, right? Arbitrage sounds dreamy, but it’s not foolproof. Timing’s a biggie. Spot a 2% gap? By the time you click, it might vanish. Slow internet or low exchange liquidity can mess things up. Then there’s slippage; prices shift mid-trade, eating your profit.

- Fees sting: Trading and transfer costs can gobble up gains.

- Exchange hiccups: Outages or sudden rule changes can freeze your funds.

- Market swings: A price crash mid-trade can turn wins into losses.

“I got burned once,” admits trader Mike. “Thought I had a sure 3% gain, but fees and a market dip left me flat.” Smart traders use a crypto arbitrage scanner to filter safe bets and set strict limits. It’s about playing sharp, not reckless.

From Old Markets to New: A Timeless Hustle

Arbitrage has deep roots. Centuries ago, merchants swapped goods across cities for profit. Stock traders in the 1900s did it with ticker tapes. Now, crypto’s the new frontier. Why’s it so hot? The market’s young, messy, full of gaps. As it grows, those gaps will shrink, but for now, tools keep the hunt alive.

Even big players are joining in. Hedge funds use bots for arbitrage. DeFi platforms like Uniswap add new spins, letting you trade within pools. “It’s Wall Street for everyone,” says analyst Priya Shah. No fancy degree needed, just a laptop and some grit.

READ ALSO: Trading Frenzy – Money Markets Get Wild

Ready to Jump In?

Arbitrage tools are rewriting the trading playbook. They make spotting deals feel like a game, with real rewards. Sure, risks lurk, but with a good crypto arbitrage scanner, you’re steps ahead. It’s not about outsmarting the market, it’s about dancing with it. So grab a tool, start small, and see where the gaps take you. The market’s calling. Will you answer?